Abstract

Indonesia has the highest prevalence of smoking (50.68%) compared to other ASEAN countries. On January 1st, 2017, the Indonesian government raised cigarette excise taxes. The purpose of this study was to analysis the impact of cigarette excise increase on cigarette consumption among adolescents aged 17 to 25 years. The study design used cross-sectional survey. A total of 153 adolescents were recruited in this study through simple random sampling technique. Questionnaires and observation papers were used in this study. A face-to-face interview was conducted to fulfill the data collection through home visit for each respondent. The data were obtained during May – June 2017. This study used paired t test analysis. The number of cigarettes consumed by adolescent decreased significantly by two cigarettes per day after the increase in cigarette excise tax. There is a significant difference of the average cigarettes price based on the brand after the implementation of cigarette excise tax increase, the difference of cigarette price is IDR 200 per stick of cigarettes after excise tax increase. Increased cigarette excise taxes may affect the increasing of cigarette prices. Threfore, it could reduce the number of cigarette consumption.

References

1. World Health Organization. Global health risks-mortality and burden of disease attributable to selected major risks. Geneva, Switzerland: World Health Organization; 2009.

2. Eriksen M, Mackay J, Schluger N, Gomeshtapeh FI, Drope J. The tobacco atlas. 5th edition. America: The American Cancer Society; 2015.

3. Kementerian Kesehatan Republik Indonesia. Laporan riset kesehatan dasar 2007. Jakarta: Pusat Penelitian dan Pengembangan Kesehatan Kementerian Kesehatan Republik Indonesia; 2007.

4. Kementerian Kesehatan Republik Indonesia. Laporan riset kesehatan dasar 2010. Jakarta: Pusat Penelitian dan Pengembangan Kesehatan Kementerian Kesehatan Republik Indonesia; 2010.

5. Kementerian Kesehatan Republik Indonesia. Laporan riset kesehatan dasar 2013. Jakarta: Pusat Penelitian dan Pengembangan Kesehatan Kementerian Kesehatan Republik Indonesia; 2013.

6. Mackay J, Ritthiphakdee B, Reddy KS. Tobacco control in Asia. The Lancet. 2013; 381(9877): 1581-7.

7. World Health Organization. Global adult tobacco survey: Indonesia report 2011. Jakarta: Pusat Penelitian dan Pengembangan Kesehatan Kementerian Kesehatan Republik Indonesia; 2011.

8. Achadi A. Regulasi pengendalian masalah rokok di Indonesia. Kesmas: National Public Health Journal. 2008; 2(4): 161-5.

9. Barber S, Adioetomo SM, Ahsan A, Diahhadi, Setyonaluri. Tobacco taxes in Indonesia. Based on: Tobacco Economics in Indonesia. [Summary]2008 [Retrieved, June 14, 2016]. Available from: http://global.tobaccofreekids.org/files/pdfs/en/Indonesia_tobacco_taxes_summary_en.pdf.

10. Lian TY, Dorotheo U. The ASEAN tobacco control atlas. 2nd edition. Thailand: South East Asia Tobacco Control Alliance; 2014.

11. Eriksen M, Mackay J, Schluger N, Gomeshtapeh FI, Drope J. The tobacco atlas, Indonesia. [Facsheet] 2015.

12. Ahmad S. Increasing excise taxes on cigarettes in California: a dynamic simulation of health and economic impacts. Preventive Medicine. 2005; 41(1): 276-83.

13. Husain MJ, Kostova D, Mbulo L, Benjakul S, Kengganpanich M, Andes L. Changes in cigarette prices, affordability, and brand-tier consumption after a tobacco tax increase in Thailand: Evidence from the Global Adult Tobacco Surveys, 2009 and 2011. Preventive Medicine. 2017.

14. Bader P, Boisclair D, Ferrence R. Effects of tobacco taxation and pricing on smoking behavior in high risk populations: a knowledge synthesis. International Journal of Environmental Research and Public Health. 2011; 8 (11): 4118-39.

15. Chaloupka FJ, Kostova D, Shang C. Cigarette excise tax structure and cigarette prices: evidence from the global adult tobacco survey and the Unites States. National Adult Tobacco Survey. Nicotine & Tobacco Research. 2014; 16 (Suppl 1): S3-9.

16. Chaloupka FJ, Straif K, Leon ME. Effectiveness of tax and price policies in tobacco control. Tobacco Control. 2011; 20 (3): 235-8

17. Van Hasselt M, Kruger J, Han B, Caraballo RS, Penne MA, Loomis B, et al. The relation between tobacco taxes and youth and young adult smoking: What happened following the 2009 United States federal tax increase on cigarettes? Addictive Behaviors. 2015; 45: 104-9.

18. Tauras JA. Can public policy deter smoking escalation among young adults? Journal of Policy Analysis and Management. 2005; 24(4): 771- 84.

19. Barber S, Adioetomo SM, Ahsan A, Setyonaluri D. Tobacco economics in Indonesia. Paris: International Union Against Tuberculosis and Lung Disease. 2008.

20. Kurnaini ZD. Kebijakan cukai hasil tembakau. Round table discussion rokok: perspektif kesehatan masyarakat vs perspektif ekonomi [Internet]. 2016.

21. Kementerian Keuangan Republik Indonesia. Peraturan menteri keuangan Republik Indonesia Nomor 147/PMK.010/2016 tentang perubahan ketiga atas peraturan menteri keuangan nomor 179 /PMK.011/2012 tentang tarif cukai hasil tembakau nomor 147/PMK.010/2016. Jakarta: Kementerian Keuangan Republik Indonesia; 2016.

22. Carpenter C, Cook PJ. Cigarette taxes and youth smoking: new evidence from national, state, and local youth risk behavior surveys. Journal of Health Economics. 2008; 27(2): 287-99.

23. Rice N, Godfrey C, Slack R, Sowden A, Worthy G. A systematic review of the effects of price on the smoking behaviour of young people. York: Public Health Research Consortium. 2009.

24. Hidayat B, Thabrany H. Model spesifikasi dinamis permintaan rokok: rasionalkah perokok Indonesia. Kesmas: National Public Health Journal. 2008; 3 (3): 99-108.

25. Fadillah R, Kiswara E. Pengaruh pengenaan pajak pertambahan nilai dan cukai rokok terhadap skema finansial produk rokok [Undergraduate thesis]. Semarang: Fakultas Ekonomika dan Bisnis Universitas Diponegoro; 2012.

26. Hardiningsih P. Pengaruh pengenaan pajak pertambahan nilai dan cukai rokok terhadap skema finansial produk rokok pada kantor bea dan cukai Kudus. Students’ Journal of Accounting and Banking. 2013; 2 (2).

27. Bigwanto M, Mongkolcharti A, Peltzer K, Laosee O. Determinants of cigarette smoking among school adolescents on the island of Java, Indonesia. International Journal of Adolescent Medicine and Health. 2015; 29 (2).

28. Chen X, Stanton B, Fang X, Li X, Lin D, Zhang J, et al. Perceived smoing norms, socioenvironmental factors, personal attitudes and adolescent smoking in China: a mediation analysis with longitudinal data. Journal of Adolescent Health. 2006; 38 (4): 359-68.

29. Rahim FK, Suksaroj T, Jayasvasti I. Social determinant of health of adults smoking behavior: differences between urban and rural areas in Indonesia. Kesmas: National Public Health Journal. 2016; 11(2): 51-5.

30. DiClemente RJ, Salazar LF, Crosby RA. Health behavior theory for public health: Principles, foundations, and applications. University of California, San Fransisco: Jones & Bartlett Publishers; 2011.

31. Glanz K, Rimer BK, Viswanath K. Health behavior and health education: theory, research, and practice. 4th Edition. San Fransisco: John Wiley & Sons; 2008.

Recommended Citation

Ramjani J , Rahim FK , Amalia IS ,

et al.

Implementation of Cigarette Excise Policy against Cigarette Consumption Reduction among Adolescent in Kuningan, Indonesia.

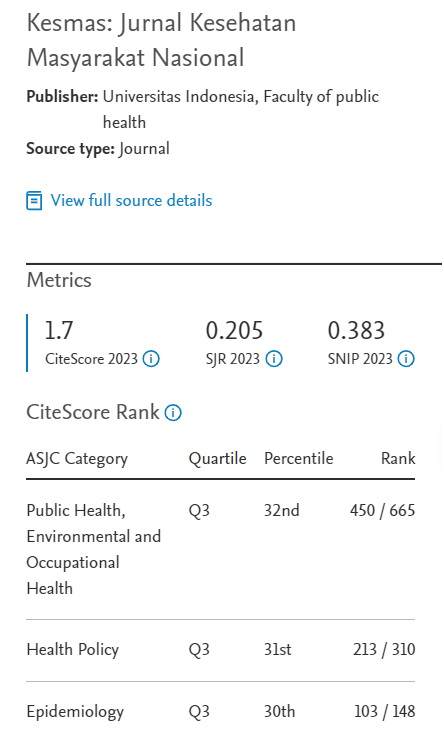

Kesmas.

2017;

12(2):

67-72

DOI: 10.21109/kesmas.v0i0.1690

Available at:

https://scholarhub.ui.ac.id/kesmas/vol12/iss2/4

Included in

Biostatistics Commons, Environmental Public Health Commons, Epidemiology Commons, Health Policy Commons, Health Services Research Commons, Nutrition Commons, Occupational Health and Industrial Hygiene Commons, Public Health Education and Promotion Commons, Women's Health Commons